Discovering the Advantages of Offshore Count On Possession Defense for Your Wealth

When it comes to safeguarding your riches, offshore trusts can supply significant advantages that you may not have actually taken into consideration. These trust funds supply a critical layer of defense versus lenders and lawful claims, while likewise enhancing your privacy. Plus, they can open up doors to distinct investment opportunities. Curious regarding how these advantages can influence your financial future and estate preparation? Let's explore what offshore trust funds can do for you.

Recognizing Offshore Trusts: A Primer

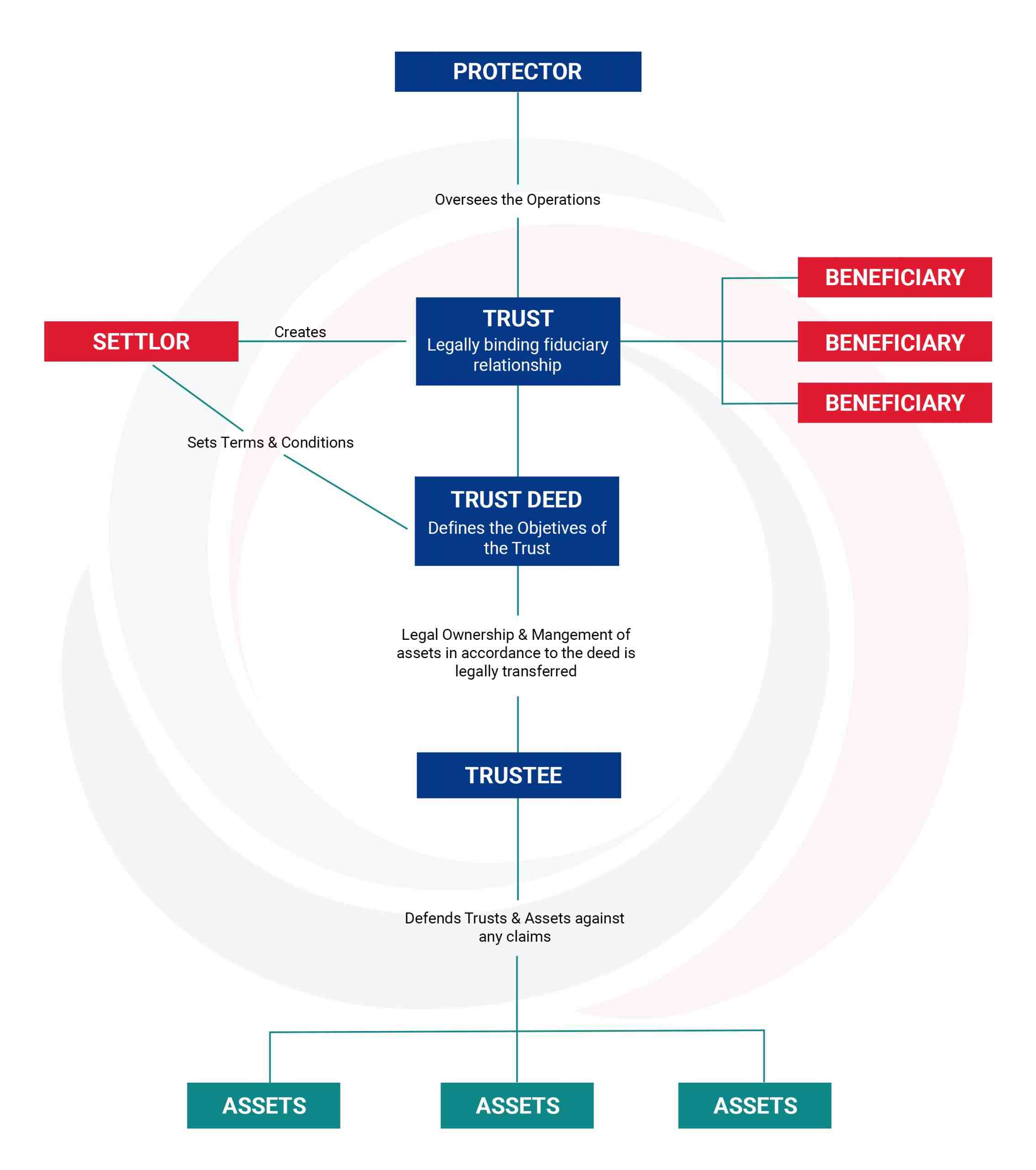

Offshore trusts offer a special means to manage and protect your assets, and recognizing their principles is vital. These counts on enable you to place your riches outside your home nation, usually in jurisdictions with positive tax obligation laws and privacy defenses. When you established up an offshore count on, you're fundamentally transferring your properties to a trustee, that manages them according to your defined terms. This structure can aid you keep control over your riches while minimizing direct exposure to local obligations and tax obligations.

You can personalize the depend fulfill your particular needs, such as picking beneficiaries and determining just how and when they get circulations. Additionally, overseas trust funds usually supply confidentiality, securing your financial affairs from public scrutiny. By comprehending these basics, you can make enlightened decisions about whether an overseas depend on lines up with your asset security strategy and long-term financial objectives. Comprehending this tool is an essential step toward safeguarding your wealth.

Lawful Securities Offered by Offshore Depends On

When you establish an overseas count on, you're taking advantage of a durable framework of lawful protections that can secure your assets from numerous risks. These depends on are frequently controlled by beneficial regulations in offshore territories, which can provide more powerful defenses versus creditors and lawful claims. For instance, several offshore depends on benefit from legal defenses that make it hard for creditors to access your assets, also in bankruptcy circumstances.

Additionally, the splitting up of lawful and beneficial ownership indicates that, as a recipient, you do not have straight control over the assets, complicating any type of efforts by financial institutions to confiscate them. Many offshore jurisdictions likewise restrict the moment framework in which claims can be made against depends on, including an additional layer of security. By leveraging these legal protections, you can significantly improve your monetary stability and secure your riches from unanticipated hazards.

Personal Privacy and Discretion Benefits

Developing an overseas trust fund not just supplies durable lawful securities however likewise ensures a high level of privacy and confidentiality for your assets. When you set up an offshore trust, your financial events are secured from public scrutiny, aiding you preserve discretion regarding your wide range. This discretion is crucial, particularly if you're concerned about potential legal actions or undesirable interest.

In numerous overseas territories, legislations protect your individual info, indicating that your possessions and financial ventures stay exclusive. You will not have to worry concerning your name appearing in public records or economic disclosures. Furthermore, working with a respectable trustee guarantees that your information is taken care of securely, more improving your privacy.

This degree of confidentiality permits you to manage your wide range without concern of exposure, supplying comfort as you guard your monetary future. Inevitably, the privacy advantages of an offshore trust can be a considerable advantage in today's progressively transparent world.

Tax Obligation Benefits of Offshore Counts On

Among one of the most compelling factors to contemplate an offshore trust fund is the potential for substantial tax advantages. Establishing an overseas depend on can aid you lower your tax obligation liabilities legally, depending upon the territory you pick. Many offshore jurisdictions use favorable tax rates, and in many cases, you could also gain from tax exemptions on earnings produced within the trust fund.

By transferring assets to an offshore count on, you his response can separate your personal riches from your taxed income, which may reduce your total tax burden. Furthermore, some territories have no funding gains tax, allowing your financial investments to expand without the immediate tax obligation implications you 'd face domestically.

Property Diversification and Investment Opportunities

By creating an offshore trust fund, you unlock to possession diversity and distinct investment chances that might not be readily available in your home nation. With an offshore depend on, you can access numerous worldwide markets, allowing you to purchase actual estate, stocks, or commodities that could be restricted or much less desirable locally. This international reach assists you spread out danger throughout different economic climates and markets, securing your riches from local financial recessions.

In addition, overseas trusts frequently supply access to specialized financial investment funds and alternate properties, such as personal equity or bush funds, which might not be available in your home market. This tactical strategy can be important in protecting and growing your wealth over time.

Succession Planning and Riches Transfer

When thinking about how to pass on your wide range, an offshore depend on can play an essential duty in efficient sequence preparation. By establishing one, you can ensure that your possessions are structured to offer for your enjoyed ones while decreasing prospective tax obligation ramifications. An offshore count on permits you to dictate how and when your recipients obtain their inheritance, offering you with comfort.

You can designate a trustee to take care of the depend on, guaranteeing your wishes are carried out even after you're gone (offshore trusts asset protection). This setup can additionally secure your possessions from creditors and lawful challenges, securing your family members's future. In addition, overseas trust funds can offer privacy, keeping your financial matters out of the Source public eye

Eventually, with careful preparation, an offshore depend on can act as an effective tool to promote riches transfer, guaranteeing that your tradition is managed and your enjoyed ones are looked after according to your wishes.

Choosing the Right Territory for Your Offshore Trust Fund

Picking the right territory for your overseas depend on is a vital consider optimizing its benefits. You'll wish to contemplate elements like legal structure, tax obligation effects, and possession security laws. Different territories supply differing degrees of confidentiality and stability, so it is vital to research study each choice thoroughly.

Look for areas recognized for their desirable trust fund legislations, such as the Cayman Islands, Bermuda, or Singapore. These territories typically offer robust lawful protections and a track record for financial security.

Additionally, consider accessibility and the convenience of managing your trust from your home nation. Consulting with a legal specialist focused on offshore trust funds can assist you in his comment is here steering through these intricacies.

Eventually, picking the suitable jurisdiction can boost your possession protection method and guarantee your wide range is protected for future generations. Make educated decisions to safeguard your financial heritage.

Frequently Asked Concerns

Can I Establish an Offshore Depend On Without a Lawyer?

You can practically establish an offshore trust fund without a lawyer, yet it's risky. You may miss out on important lawful subtleties, and problems can develop. Hiring an expert warranties your trust conforms with laws and protects your rate of interests.

What Occurs if I Relocate to An Additional Nation?

Are Offshore Trusts Legal in My Country?

You'll require to check your regional legislations to establish if offshore trust funds are legal in your country. Laws differ extensively, so speaking with a lawful specialist can aid ensure you make informed choices concerning your assets.

Exactly How Are Offshore Depends On Regulated Internationally?

Offshore counts on are regulated by international laws and guidelines, varying by jurisdiction. You'll locate that each nation has its own policies concerning taxation, reporting, and compliance, so it's vital to comprehend the specifics for your scenario.

Can I Access My Properties in an Offshore Depend On?

Yes, you can access your properties in an overseas trust fund, yet it relies on the count on's framework and terms. You should consult your trustee to understand the specific processes and any kind of constraints entailed.

Final thought

To sum up, offshore trusts can be a clever choice for protecting your wide range. When thinking about an overseas depend on, take the time to choose the ideal jurisdiction that straightens with your goals.